|

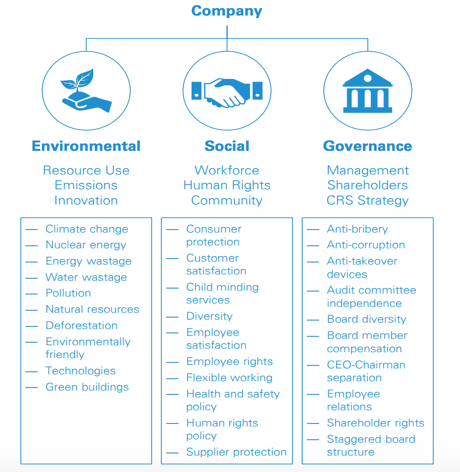

Would you invest in tobacco, oil or gambling corporations ("Sin" stocks) if you deemed them to be lucrative investments? If so, would you tell your friends and family about it? What about financial institutions that lend out money for arctic drilling? The lines can be blurred. Nobel prize winner economist Milton Friedman argued that a company has no moral obligation other than increasing shareholder’s wealth, albeit within the boundaries of the law. That was in 1962. Social norms, beliefs and values have evolved so much that it makes us wonder if in 1962 people went clubbing seals after work. What is Responsible Investing (RI)? Investors are becoming more selective about their investments. They are no longer only looking at the bottom line but also the impact of their investments on society as a whole. RI is driven by Environmental, Social and Governance (ESG) factors.

Companies are now encouraged to disclose material aspects of their operations to enable investors and stakeholders to assess their behaviour via corporate social responsibility reporting. Can RI and investment performance coexist? Don’t you hate it when you’re told: “You can’t get what you want”. The world tells you everyday that you can’t have it both ways. Junk food or healthy choice? Fast, sexy car or economically sensible one? In the investment world the choice was make money on stocks or save the planet, but you couldn’t have it both ways. Can RI and investment performance coexist? What the Believers say

What the Naysayers say

What the Data says Let’s look at the numbers. The Pax Balanced fund, launched on August 10, 1971, is the oldest operating RI fund in the business. The Vice fund launched on August 30, 2002, is the industry's oldest “Sin” stocks fund. Annualized Returns Over a 10-year Period Bottom Line

If you are only looking to make a solid investment, a diversified portfolio of companies that focus on shareholder’s financial interest will historically serve you better. However, investing in RI companies may help you sleep better at night. In the end, it really comes down to your own moral code. If using professional services, it is important to clearly communicate to them your economic and social responsibility priorities. [1] Smith, Lisa (2019, June 25). Socially Responsible Investing vs Sin Stocks. https://www.investopedia.com/articles/stocks/08/sri-versus-sin-stock.asp [2] KPMG. (2018, February). Responsible Investing – A Fad or the Future. https://assets.kpmg/content/dam/kpmg/uk/pdf/2018/03/kpmg_responsible_investment_a_fad_or_the_future.pdf [3] Ferreira, Victor (2019, November 25). Financial Post. The inconvenient truth about Responsible Investing. https://business.financialpost.com/investing/the-inconvenient-truth-about-responsible-investing-an-fp-investigation Comments are closed.

|

925 de Maisonneuve West, Suite 275, Montreal QC H3A 0A5 514.686.5023 [email protected]

Copyright © 2017 The Everton Carlisle Group Inc. | All rights reserved.

Copyright © 2017 The Everton Carlisle Group Inc. | All rights reserved.

925 de Maisonneuve O, bureau 275, Montréal QC H3A 0A5 514.686.5023 [email protected]

Droits d'auteur © 2017 Le Groupe Everton Carlisle Inc. | Tous droits réservés.

Droits d'auteur © 2017 Le Groupe Everton Carlisle Inc. | Tous droits réservés.